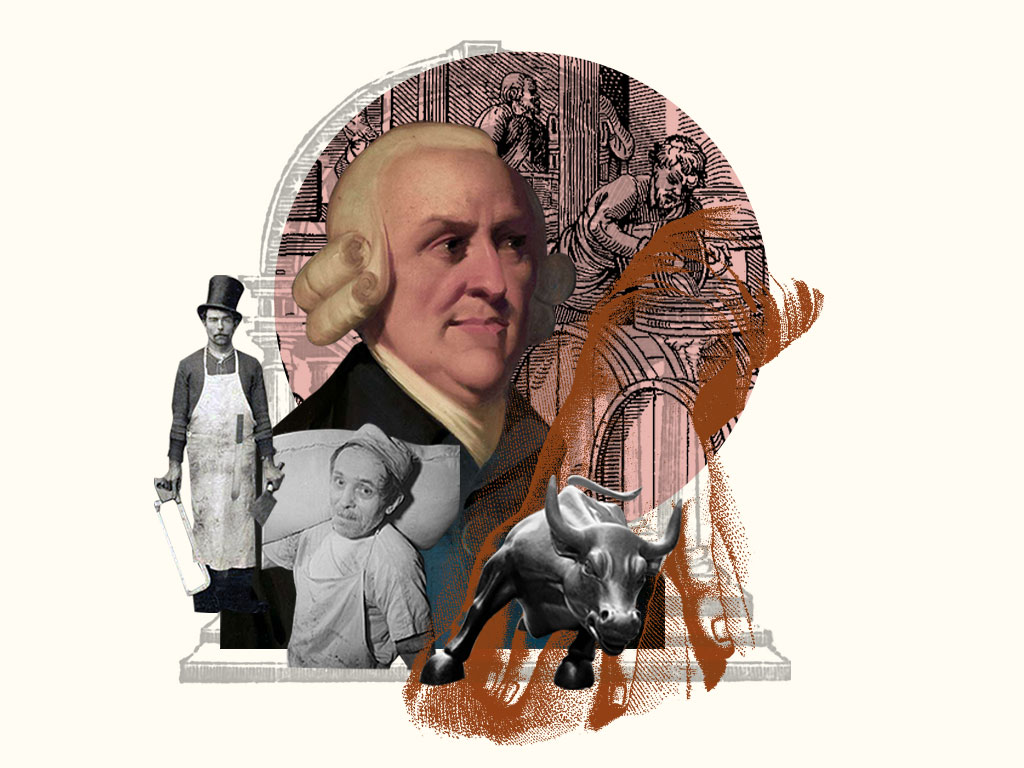

It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest (18).

Adam Smith

An Inquiry into the Nature & Causes of the Wealth of Nations

Adam Smith

Cannan, ISBN: 978-0226763743

Vol 1, Bk 1: Ch 1, 2, 6, 7, 8, 9, 10 (only Conclusion of the Chapter)

In Chapters 1 and 2, Smith lays out his argument that mankind’s natural selfishness leads him to barter and trade with others for what he wants by appealing to their selfishness. Humans realize that they can trade more by specializing in their work because this allows them to produce more. Thus the natural tendency to trade leads to the division of labor, which in turn unlocks the productive capacity of nations. The division of labor does this by causing workers to gain expertise, save time, and innovate. All this extra amount of labor can then be traded for things beyond mere subsistence and from this arises (ideally) the wealth of everybody. Chapter 6 is Smith’s key analysis of price into the wages of labor, the profits of stock, and the rents of land. Understanding the relations and interests of these three estates is essential to understanding Smith. Chapter 7 presents his theory of supply and demand and explains the importance of perfect liberty in economic markets. Chapters 8 and 9 deal with the effect of market fluctuations and the interests of the two estates of labor and stock, respectively. The Conclusion of the Chapter explains how the varied interests of the three estates are connected to the prosperity or decline of society as a whole.

Vol 1, Bk 4: Ch 2

This chapter presents Smith’s arguments for the importance of free markets internationally. Once again, his idea is that letting individuals make their own selfish economic decisions will lead, by an “invisible hand,” to the greatest economic value for the society as a whole. Regulation can only ever artificially channel the quantity of labor into certain sectors, but can never increase the total amount beyond what it will naturally settle on if left undisturbed. The only time Smith thinks regulation is justified is when it is necessary in war time for defense and when a domestic product is already being taxed, it is necessary to tax the corresponding foreign product to even the playing field.

Vol 2, Bk 5: Ch 2, Part 2, Art 3, Art 4, Capitation Taxes, Taxes Upon Consumable Commodities (up to 403)

These sections are about just/effective taxation schemes. Smith often elides between considerations of justice and practical considerations of the effects of various tax schemes on the economy. Smith thinks taxes ought to be paid by all of the estates at proportional rates, and that taxes should be minimal relative to what the state needs. Smith argues that taxes on the wages of labor lead to them requiring higher wages, which must be paid by their employer. The employer in turn will raise the cost of his goods to compensate for his lost profits. So ultimately, the consumer ends up paying for the increase in taxes through higher prices. Smith ultimately claims that it is impossible to tax everyone directly because “The state of a man’s fortune varies from day to day, and without an inquisition more intolerable than any tax, and renewed at least once a year, can only be guessed at” (396). What he settles on is a tax on consumables—a sales tax—as the best way to estimate a tax proportional to the person’s wealth. He argues that in order for such a taxation scheme to avoid the negative impact of taxes on wages discussed above, it must be a tax on luxuries and not necessities.

Why This Text is Transformative?

Smith’s analyses of how interventions and changes in one section of the economy have unforeseen ramifications elsewhere is always fascinating and insightful.

Adam Smith’s Wealth of Nations is the foundational argument for capitalism, classical liberalism, neoliberalism, and derivatively, libertarianism. It is the central text of political economy. While the work is often invoked by the ideologues of free-market capitalism, it is just as often misunderstood, misread, or ignored by those same proponents. Smith’s analyses of how interventions and changes in one section of the economy have unforeseen ramifications elsewhere is always fascinating and insightful. His fundamental belief that the self-interested economic behavior of individuals can lead, as an epiphenomenon, or as he says, by an “invisible hand,” to economic prosperity for the whole of society, can be seen as the ultimate conclusion to a line of thought initiated by Thomas Hobbes.

A Focused Selection

Study Questions

1) In Book 1 Chapter 6, Smith claims that the value of an exchanged product is proportional to the quantity of labor (accounting for amount, skill, and difficulty) required for producing it. He then introduces the concepts of the profits of stock and the rents of landowners, in addition to the wages of labor, as constitutive of the value of a product. However, these latter two sources of value are still measured by quantity of labor. So when you pay a price for a product (measured by your labor), you are actually exchanging your labor for not only someone else’s labor, but in addition you are paying for someone else’s profits and rents. Where do the profits of stock and the rent of landowners come from and can they be justified? At the end of this chapter, Smith seems to recognize that this added, or surplus value, would, if reinvested into the production process, lead to successively greater and greater income. What is his explanation for why we do not always see this? Is this a plausible explanation?

2) Consider Book 1 Chapter 8, 9, and the Conclusion of the Chapter section of Chapter 10. Why is it that the manufacturer’s, or the estate that lives by the profits of stock, interest is contrary to society as a whole? What kinds of policy interventions can you think of that would fix this? What kinds of negative effects, economically or morally, might those interventions have?

3) In Book 4 Chapter 2, what is Smith’s argument for free markets? Is this a good argument? Is it true that markets always do better, overall, when completely unregulated? Think about a society where people could establish themselves as doctors or lawyers without a medical license or being board certified. How would Adam Smith handle this counterexample to his theory of free markets? Would you want to live in such a world?

Building Bridges

A Recommended Pairing

A wonderful short novel by Graham Greene, Monseigneur Quixote, recasts Cervantes’ magnum opus in a way that captures much of the humor and pathos in a more modern context, as the adventures of a Roman Catholic priest and a communist mayor taking to the road together in Spain during the Franco years. The richly imagined characters and their conversations make it clear that the issues that drive Don Quixote’s idealistic quest are not raised only in books of chivalry. How do we live with a commitment to the ideals of a religious faith or a political ideology which, though noble, may not fit easily with and may have unfortunate consequences in the unforgiving world in which we find ourselves? What difference does friendship make in our lives?

Supplemental Resources

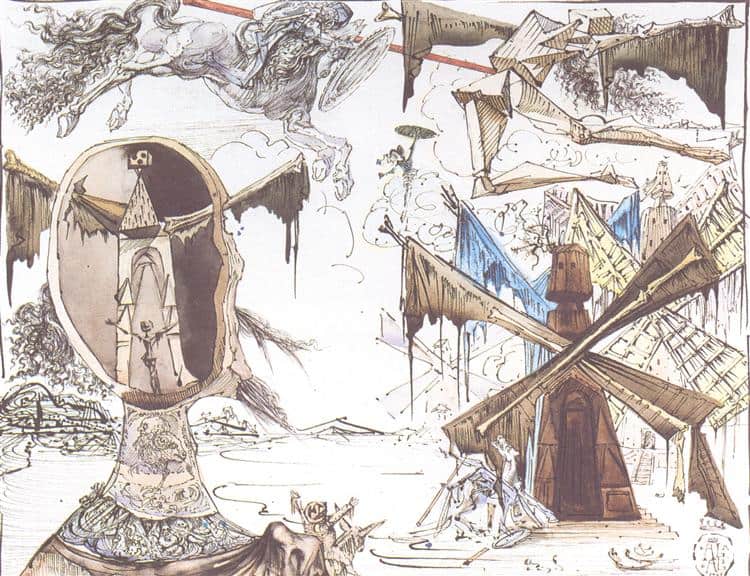

Don Quixote and the Windmills, 1945 - Salvador Dali - WikiArt.org

Don Quixote has been an inspiration for many visual artists. Spanish surrealist Salvador Dali returned to the novel multiple times throughout his long career, creating sketches, paintings, and sculptures of Don Quixote and Sancho, depicting important episodes in the book. A pairing of an episode with one of Dali’s works can lead to a stimulating discussion.

What details do students notice? What do his artistic choices suggest about his interpretation of the characters? To the extent that students are familiar with the story of Don Quixote, it is likely to be as it is filtered through the musical The Man of La Mancha. The musical has its own merits, and is framed by the interesting device of placing Cervantes on stage as a narrator, but of course it is impossible for it to capture much of the complexity of the book – and it alters the ending dramatically. Students may find it interesting to compare the two endings.

Text Mapping

Discipline Mapping

Political Science/Government

Sociology

Philosophy & Religion

Page Contributor